LOANS

Auto / Motorcycle Loan

Top| Product Type | Term | APR as low as |

|---|---|---|

| New 2025 – 2026 | 60 Months | 5.99% |

| New 2025 – 2026 | 66 Months | 6.24% |

| New 2025 – 2026 | 72 Months | 6.49% |

| New 2025 – 2026 | 75 Months | 6.74% |

| New 2025 – 2026 | 84 Months | 6.99% |

| Used 2022 – 2024 | Up to 60 Months | 5.99% |

| Used 2022 – 2024 | Up to 66 Months | 6.24% |

| Used 2022 – 2024 | Up to 72 Months | 6.49% |

| Used 2022 - 2024 | Up to 75 Months | 6.74% |

| Used 2021 | Up to 60 Months | 6.99% |

| Used 2021 | Up to 66 Months | 7.24% |

| Used 2021 | Up to 72 Months | 7.49% |

| Used 2020 | Up to 60 Months | 7.74% |

| Used 2020 | Up to 66 Months | 7.99% |

| Used 2020 | Up to 72 Months | 8.24% |

| Used 2019 | Up to 48 Months | 8.49% |

| Used 2019 | Up to 60 Months | 8.74% |

| Used 2018 | Up to 48 Months | 8.99% |

| Used 2018 | Up to 60 Months | 9.24% |

| Used 2017 | Up to 36 Months | 9.99% |

| Used 2017 | Up to 48 Months | 10.24% |

| Used 2016 | Up to 36 Months | 10.99% |

| Used 2016 | Up to 42 Months | 11.24% |

| Used 2015 | Up to 36 Months | 11.99% |

| Used 2014 | Up to 36 Months | 12.99% |

| Classic Vehicle 20+ Years | 60 Months | 9.49% |

Loans may qualify for additional discounts based on the use of additional services. All Certificate of Deposit Rates are quoted at the highest possible rate with a $10,000+ deposit and term. Auto Loan Rates are based on the vehicle, and applicants credit worthiness. Mortgage rates vary daily. All rates are subject to change. First-time mortgage applicants are encouraged to apply here. Follow this link to learn more about Home Equity Line of Credit Loans. Rates effective as of February 1, 2026.

RV & Boats

Top| Product Type | Term | APR as low as |

|---|---|---|

| Please contact us for rates and pre-approvals | Varies | % |

Loans may qualify for additional discounts based on the use of additional services. All Certificate of Deposit Rates are quoted at the highest possible rate with a $10,000+ deposit and term. Auto Loan Rates are based on the vehicle, and applicants credit worthiness. Mortgage rates vary daily. All rates are subject to change. First-time mortgage applicants are encouraged to apply here. Follow this link to learn more about Home Equity Line of Credit Loans. Rates effective as of February 1, 2026.

Home Mortgage Rates

Top| Product Type | Term | APR |

|---|---|---|

| First Mortgages | 5-30 Years | Rates Fluctuate Daily with Market% |

| Home Equity Up to 80% LTV | 5 Years | 6.25% |

| Home Equity Up to 80% LTV | 10 Years | 6.75% |

| Home Equity Up to 80% LTV | 15 Years | 7.25% |

| Home Equity Line of Credit | Variable Rate | Currently 6.75% |

Loans may qualify for additional discounts based on the use of additional services. All Certificate of Deposit Rates are quoted at the highest possible rate with a $10,000+ deposit and term. Auto Loan Rates are based on the vehicle, and applicants credit worthiness. Mortgage rates vary daily. All rates are subject to change. First-time mortgage applicants are encouraged to apply here. Follow this link to learn more about Home Equity Line of Credit Loans. Rates effective as of February 1, 2026.

Personal Loan Rates

Top| Product Type | Term | APR as low as |

|---|---|---|

| Personal Loan | Varies | 10.24% |

Loans may qualify for additional discounts based on the use of additional services. All Certificate of Deposit Rates are quoted at the highest possible rate with a $10,000+ deposit and term. Auto Loan Rates are based on the vehicle, and applicants credit worthiness. Mortgage rates vary daily. All rates are subject to change. First-time mortgage applicants are encouraged to apply here. Follow this link to learn more about Home Equity Line of Credit Loans. Rates effective as of February 1, 2026.

CHECKING & SAVINGS

Savings Rates

Top| Product Type | Term | APR | APY |

|---|---|---|---|

| All balance amounts | 0.02% | 0.02% |

Loans may qualify for additional discounts based on the use of additional services. All Certificate of Deposit Rates are quoted at the highest possible rate with a $10,000+ deposit and term. Auto Loan Rates are based on the vehicle, and applicants credit worthiness. Mortgage rates vary daily. All rates are subject to change. First-time mortgage applicants are encouraged to apply here. Follow this link to learn more about Home Equity Line of Credit Loans. Rates effective as of February 1, 2026.

Checking Rates

Top| Product Type | Term | APR | APY |

|---|---|---|---|

| Rewards Checking | 0.02% | 0.02% |

Loans may qualify for additional discounts based on the use of additional services. All Certificate of Deposit Rates are quoted at the highest possible rate with a $10,000+ deposit and term. Auto Loan Rates are based on the vehicle, and applicants credit worthiness. Mortgage rates vary daily. All rates are subject to change. First-time mortgage applicants are encouraged to apply here. Follow this link to learn more about Home Equity Line of Credit Loans. Rates effective as of February 1, 2026.

INVESTMENTS

Money Market Rates

Top| Product Type | Term | APR | APY |

|---|---|---|---|

| $2,000 - $9,999 | 0.10% | 0.10% | |

| $10,000 - $24,999 | 0.15% | 0.15% | |

| $25,000 - $49,999 | 0.20% | 0.20% | |

| $50,000.00+ | 0.30% | 0.30% |

Loans may qualify for additional discounts based on the use of additional services. All Certificate of Deposit Rates are quoted at the highest possible rate with a $10,000+ deposit and term. Auto Loan Rates are based on the vehicle, and applicants credit worthiness. Mortgage rates vary daily. All rates are subject to change. First-time mortgage applicants are encouraged to apply here. Follow this link to learn more about Home Equity Line of Credit Loans. Rates effective as of February 1, 2026.

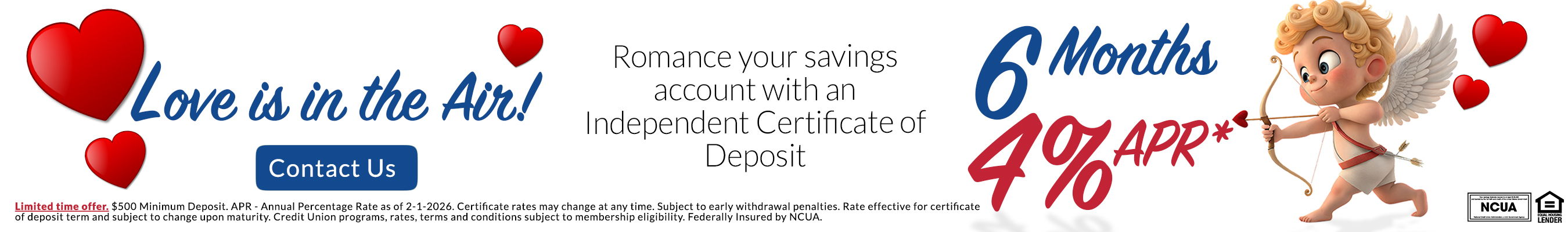

CD Rates

Top| Product Type | Term | APR | APY |

|---|---|---|---|

| CD $500 Minimum | 6 Months | 2.75% | 2.78% |

| CD $500 Minimum •Special• | 6 Months | 4.00% | 4.07% |

| CD $500 Minimum | 1 Year | 3.75% | 3.80% |

| CD $500 Minimum | 2 Years | 3.00% | 3.03% |

| CD $500 Minimum | 3 Years | 2.00% | 2.02% |

| CD $500 Minimum | 4 Years | 1.70% | 1.71% |

| CD $500 Minimum | 5 Years | 1.65% | 1.66% |

Loans may qualify for additional discounts based on the use of additional services. All Certificate of Deposit Rates are quoted at the highest possible rate with a $10,000+ deposit and term. Auto Loan Rates are based on the vehicle, and applicants credit worthiness. Mortgage rates vary daily. All rates are subject to change. First-time mortgage applicants are encouraged to apply here. Follow this link to learn more about Home Equity Line of Credit Loans. Rates effective as of February 1, 2026.